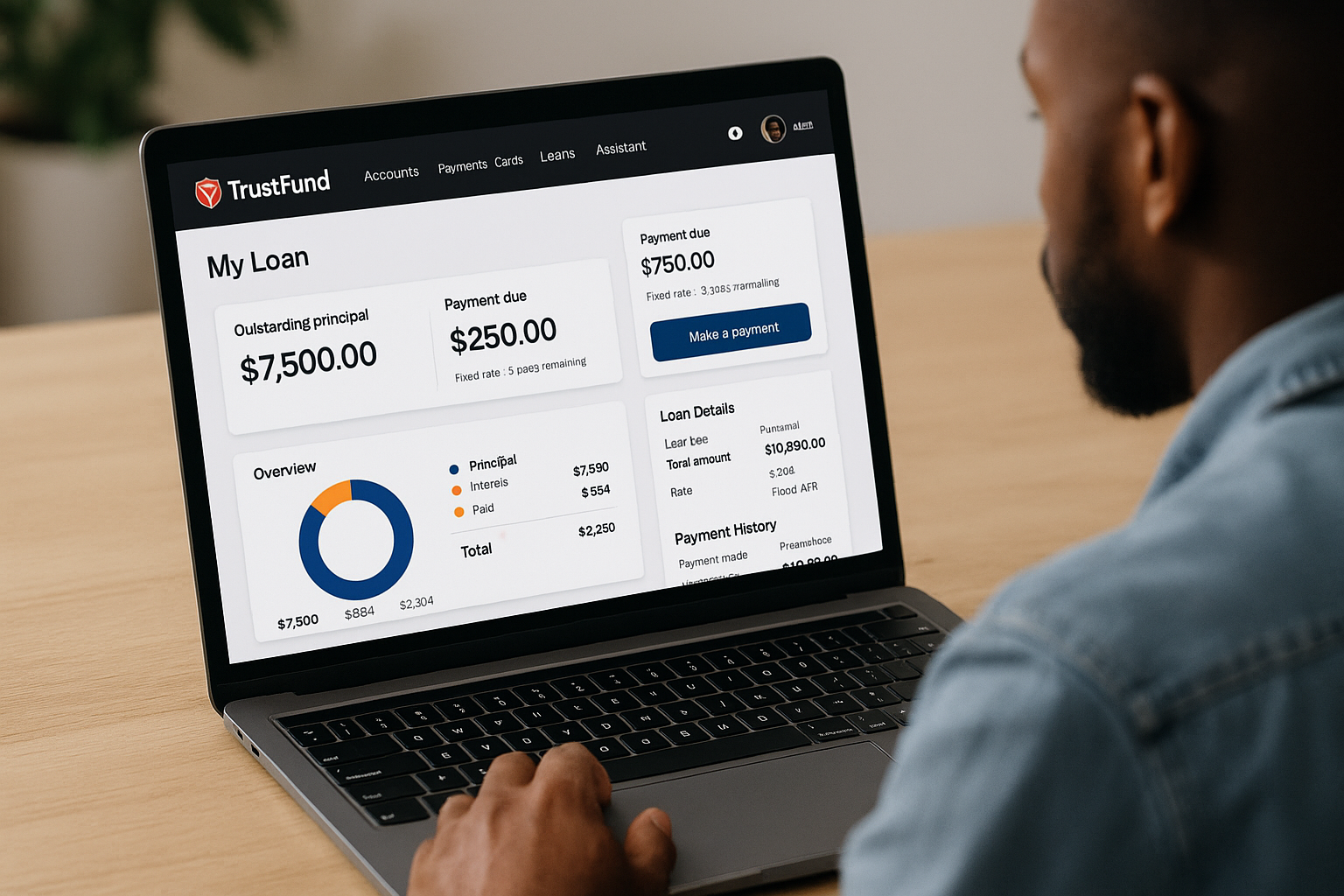

Personal Loans

Fixed-rate financing from $5,000 to $75,000 with predictable monthly payments and no origination surprises.

- Same-day funding for qualified borrowers

- 0.25% rate discount for autopay from a OrendaTrust account

- Payoff simulator and early repayment without penalties

Home Equity Solutions

Tap into the value of your home with flexible HELOC and fixed-rate options supported by local mortgage specialists.

- Interest-only draw options for qualified borrowers

- Rate lock when you’re ready to convert to fixed payments

- Property valuation provided by OrendaTrust

Auto & Lifestyle

Finance vehicles, tuition, or medical procedures with terms tailored to your cash flow and financial wellness goals.

- Dealer direct or private-party options

- Deferred first payment programmes available

- Free credit coaching to help optimise your rate